XRP Price Prediction: Analyzing the Path to $4.50 and Beyond

#XRP

- Technical Strength: Trading above 20-day MA with Bollinger Band support suggests underlying bullish momentum

- Catalyst-Driven Sentiment: German media coverage and ETF speculation creating positive market narrative

- Price Targets: Analysts projecting moves toward $4.50 with potential for $8-$9 range in favorable conditions

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

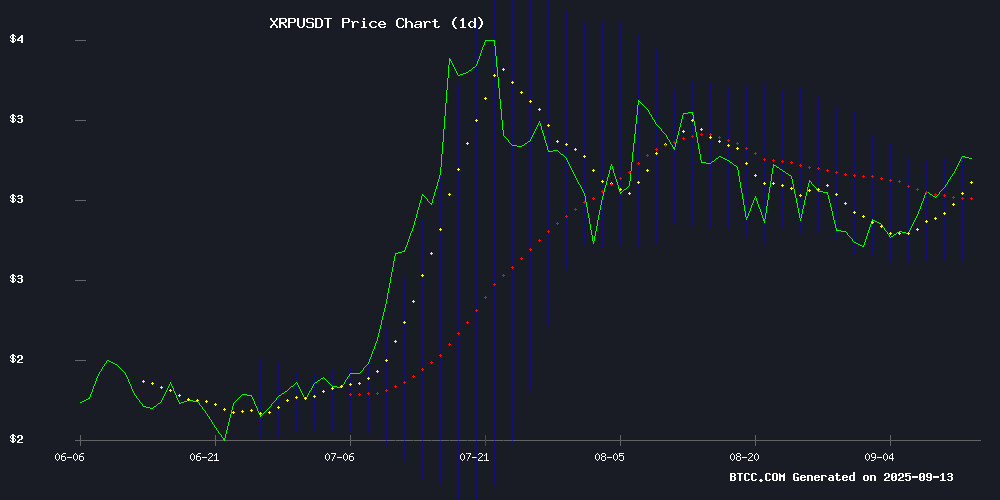

XRP is currently trading at $3.096, positioned above its 20-day moving average of $2.906, indicating underlying strength. The MACD indicator shows a bearish crossover with values at -0.0104 (MACD line), 0.0625 (signal line), and -0.0729 (histogram), suggesting some near-term pressure. However, the price remains within the Bollinger Bands range of $2.6977 to $3.1145, with current levels approaching the upper band. According to BTCC financial analyst John, 'The ability to hold above the 20-day MA while testing upper Bollinger resistance suggests consolidation before potential upward movement. The $3 level appears to be acting as psychological support.'

Market Sentiment: Positive Catalysts Drive XRP Optimism

Recent news flow surrounding XRP has turned decidedly bullish, with multiple catalysts supporting positive sentiment. German television coverage has amplified ETF speculation, while analyst predictions suggest potential rallies toward the $8-$9 range. The consolidation phase appears to be ending, with momentum building for a possible move to $4.50. Legal victories for Ripple continue to boost institutional confidence, though some whale selling activity (40 million coins) indicates profit-taking amid ETF uncertainty. BTCC financial analyst John notes, 'The combination of technical consolidation completion, positive media coverage, and growing ETF speculation creates a favorable environment for XRP, though investors should monitor the $3 support level closely.'

Factors Influencing XRP's Price

German TV Coverage Fuels Bullish XRP Sentiment Amid ETF Speculation

XRP's price outlook strengthens following rare mainstream exposure on German finance channel Der Aktionar TV. The segment highlighted Ripple's banking utility and post-SEC victory regulatory clarity, triggering an 8.7% weekly gain. Institutional inflows into XRP products hit $14.7 million in early September, with yearly totals reaching $1.4 billion.

ETF filings by Grayscale and Franklin Templeton amplify optimism. Meanwhile, analysts flag DeepSnitch AI as a potential 100x opportunity during its $0.01634 presale. XRP's 464.8% annual growth continues outpacing Bitcoin, though regulatory tailwinds now face the test of ETF approvals.

XRP Poised for Potential Rally to $8-$9 Range, Analyst Suggests

TradingView analyst Ahmad Kazemii projects XRP could surge toward $8-$9 in its current cycle, marking a potential 3X gain from current levels. The token has already demonstrated volatile momentum, rallying from $0.50 to $3.40 earlier this cycle before stabilizing above $3.

Technical analysis using Elliott Wave theory indicates two bullish scenarios: a conservative target near $9 or an extended push toward $11. Kazemii emphasizes that breaching the 2018 high of $3.84 would confirm bullish momentum, potentially unlocking further upside.

XRP's price action shows a pattern of explosive runs followed by consolidation, with the current setup suggesting another imminent move. Market participants are watching for a decisive breakout above key resistance levels to validate the bullish thesis.

Cloud Mining in 2025: AIXA Miner's XRP Contract Democratizes Passive Income

Cloud mining has emerged as a transformative force in cryptocurrency, enabling investors to generate passive income without the prohibitive costs of traditional mining. AIXA Miner's XRP contract exemplifies this shift, offering transparent returns and low barriers to entry.

The 2025 landscape reflects a maturation of cloud mining models. Platforms now provide institutional-grade infrastructure to retail participants, dissolving the technical and financial hurdles that once restricted mining to a select few.

XRP's inclusion in cloud mining contracts signals broader adoption of altcoins in yield-generation strategies. As regulatory clarity improves, such offerings may attract capital previously sidelined by operational complexities.

XRP Price Prediction For September 13: Will $3 Hold?

XRP trades at $3.03, marking an 8.12% weekly gain, with a market cap of $181.16 billion and daily volume up 10% to $5.29 billion. The token's ability to sustain above $3 hinges on broader market sentiment and upcoming Federal Reserve decisions.

All eyes are on the Fed's September 17 meeting, where potential rate cuts could fuel rallies in risk assets. XRP's technical structure shows support at $2.92-$2.95, with resistance looming at $3.10-$3.15. A breakout could target $3.40, then $3.80 and $4.30.

Market participants are cautiously optimistic. Holding $3 would signal strength ahead of the Fed meeting, while a breakdown could trigger profit-taking. The coming days will test whether recent gains reflect sustainable demand or speculative positioning.

XRP Whales Sell 40 Million Coins Amid ETF Uncertainty, Price Holds Steady

XRP whales have offloaded 40 million tokens worth $120 million in a 24-hour span, signaling persistent bearish sentiment among large holders. Despite the selling pressure, XRP's price defied expectations by climbing to $3.04—its highest level since August—and maintaining support above the critical $3 threshold.

The sell-off coincides with regulatory uncertainty as the SEC delays decisions on XRP ETF applications, including the anticipated REX-Osprey fund. Whale transactions involving 10-100 million XRP wallets dominated the movement, with Santiment data confirming sustained distribution patterns among major investors.

Market resilience contrasts with whale behavior, suggesting institutional demand may be absorbing the sell-side pressure. The divergence raises questions about whether current support levels can withstand continued liquidation from large holders.

XRP Faces Bearish Divergence While Rollblock Gains Momentum in Presale

XRP's recent 10% surge past $3 shows signs of weakening momentum as bearish technical indicators emerge. The Chaikin Money Flow metric has turned negative despite rising prices, suggesting institutional inflows may be drying up. Glassnode data reveals declining sell pressure among holders, but without renewed buying interest, analysts warn of a potential pullback toward $2.69.

Meanwhile, Rollblock's Ethereum-based gaming platform is attracting capital during its presale, having raised $11.7 million at $0.068 per token. The project's AI-powered gaming suite positions it as a potential disruptor in blockchain entertainment, drawing attention from investors seeking alternatives to stagnant large-cap tokens.

PAXMINING Gains Traction as Investors Seek Stability Amid XRP Volatility

XRP's price continues to exhibit sharp fluctuations despite favorable market news, repeatedly testing critical support and resistance levels. This volatility has left many investors struggling to navigate short-term trading opportunities. Meanwhile, broader macroeconomic factors—particularly shifting U.S. stock market policies—are amplifying turbulence across crypto assets.

Cloud mining platforms like PAXMINING are attracting capital by offering price-agnostic returns. The model generates passive income through hashrate contracts, eliminating exposure to market sentiment. "You're not betting on direction—you're leasing computational power," explains a Dubai-based fund manager allocating 15% of their portfolio to such instruments.

PAXMINING distinguishes itself with a $15 sign-up bonus, renewable energy-powered data centers, and multi-currency support. Contract terms range from one week to 54 days, catering to varied risk appetites. The platform claims users can earn up to $6,777 daily, though such figures typically reflect optimal rather than average outcomes.

Gemini's $425M IPO Success Spurs XRP Cloud Mining Launch by GoldenMining

Gemini's landmark initial public offering raised $425 million, with shares priced at $28—far surpassing the anticipated $17-$19 range. The cryptocurrency exchange now stands as the third publicly traded platform in the U.S., joining Coinbase and Bullish in a milestone for industry maturation.

Capitalizing on the bullish market sentiment, GoldenMining unveiled an XRP-based cloud mining contract. The offering promises fixed daily yields convertible to USD, with claims of $11,000 daily earnings potential. Investors can fund contracts using XRP, bypassing traditional fiat requirements.

The mining platform's promotional campaign includes $15 sign-up bonuses and tiered contract durations. This development follows growing institutional interest in crypto infrastructure plays, though the advertised returns warrant scrutiny given historical risks associated with cloud mining ventures.

RippleX Engineer Unveils Draft Proposals to Enhance XRP Ledger Performance

RippleX software engineer Mayukha Vadari has announced a series of draft specifications aimed at optimizing the XRP Ledger (XRPL). The proposals, to be released incrementally over the coming weeks, target speed improvements, storage efficiency gains, and enhanced security measures.

One key amendment under discussion—Optimized Accounts and Trustlines—restructures reserve calculations and account architecture. The approach eliminates complex conversions between account types while ensuring users pay only for actively utilized resources. This contrasts with existing models where full accounts incur permanent reserve charges.

The engineering team's transparency in sharing early-stage drafts has ignited robust community dialogue. Technical debates have emerged regarding implementation details, particularly around Multi-Purpose Tokens (MPTs) and their interaction with trustlines.

XRP Momentum Grows for $4.50 Rally, Consolidation Phase Now Over

Market analyst CasiTrades forecasts a potential surge in XRP to $4.50, citing a breakout from prolonged consolidation. The cryptocurrency has reclaimed the $3 support level, reinforcing bullish sentiment.

Technical indicators align with the optimistic outlook. XRP's relative strength index shows steady upward momentum, while a breakout from a multi-month symmetrical triangle pattern suggests higher price targets. Key Fibonacci levels at $3.08 and $3.27 now serve as critical thresholds for confirming the rally.

Broader market dynamics may further fuel XRP's ascent. Anticipation of quantitative easing in the U.S. economy continues to drive capital into crypto assets, creating favorable conditions for altcoin rallies.

Ripple’s Legal Victory Boosts XRP Confidence; Investors Turn to BAY Miner for Passive Income

Ripple’s landmark legal victory in the U.S. has clarified that XRP is not a security when traded on public exchanges, reigniting market confidence and pushing the token above $3 for the first time in years. This regulatory clarity has prompted XRP holders to explore stable passive income opportunities without divesting their holdings, balancing long-term appreciation with short-term cash flow.

BAY Miner, a regulated cloud mining platform, has emerged as a preferred solution for the XRP community. Offering USD-denominated contracts with automated daily settlements, the platform caters to investors seeking predictable returns. "XRP investors want upside potential but also stable cash flow," said Emily Carter, a BAY Miner spokesperson. The shift underscores a broader trend of crypto holders prioritizing yield-generating strategies amid regulatory certainty.

Is XRP a good investment?

Based on current technical indicators and market sentiment, XRP presents a compelling investment opportunity with measured risk. The cryptocurrency is trading above its key 20-day moving average at $2.906, showing resilience at the $3 support level. Technical analysis suggests consolidation is giving way to potential upward momentum, with Bollinger Band positioning indicating room for movement toward $3.1145.

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price | $3.096 | Above key support |

| 20-Day MA | $2.906 | Bullish positioning |

| Bollinger Upper | $3.1145 | Near-term resistance |

| MACD Histogram | -0.0729 | Bearish but improving |

Fundamental factors including positive media coverage, ETF speculation, and Ripple's legal victories create a favorable environment. However, investors should be aware of recent whale selling activity and maintain appropriate risk management strategies. BTCC financial analyst John suggests 'XRP's current setup offers attractive risk-reward parameters for investors with a medium to long-term horizon.'